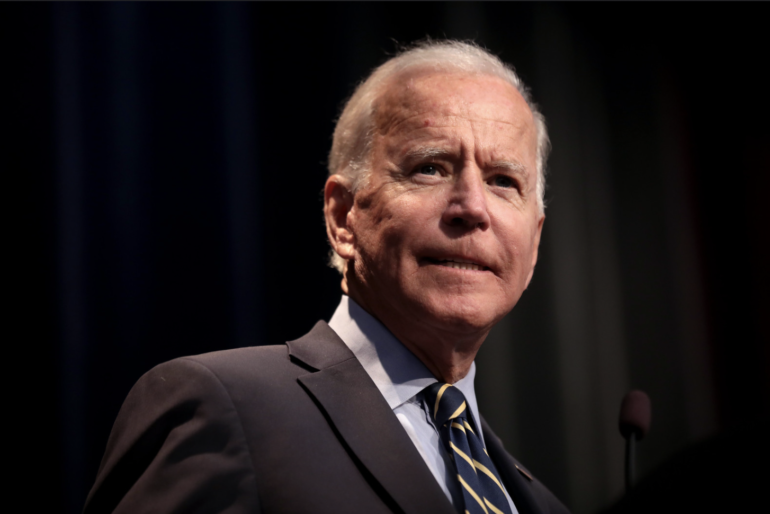

President Biden is reportedly scheduled to publicly propose a slew of tax increases on rich individuals and businesses as part of a budget proposal that he claims will cut the deficit by $2 trillion over the next decade, setting up a major new showdown with Republicans on Capitol Hill.

At his State of the Union speech last month, Biden told Congress that his budget will reduce the deficit and extend the stability of the Medicare Trust Fund by demanding the affluent and big businesses begin to pay their “fair share.”

The White House proposed raising the Medicare surtax on earned and unearned income above $400,000 from 3.8 percent to 5 percent on Tuesday.

Late last month, the president suggested a new tax on rich households, requiring individuals and families worth more than $100 million to pay a 20% tax on income and unrealized gains on liquid assets like stocks.

Republicans believe Biden’s budget will be dead on arrival when the president presents it to Congress on Thursday.

The administration is also anticipated to seek a quadrupling of the stock repurchase tax included in the Inflation Reduction Act.

An act which Democrats enacted on party-line votes in the House and Senate last year.

The act in question imposed a 1% fee on corporate stock buybacks.

Biden is likely to revive two key components of his 2021 Build Back Better agenda: boosting the highest marginal income tax rate from 37% to 39.6% and increasing the corporation tax rate from 21% to 28%.

Senate Majority Leader Charles Schumer (D-NY) applauded Biden’s budget on Tuesday and urged House Republicans to present their own plan to decrease the deficit before discussing lifting the debt ceiling.

However Senate Minority Leader Mitch McConnell claimed that Americans can “thank” the GOP controlled House for the fact that Biden’s proposed tax increases “won’t see the light of day.”

[READ MORE: Newly Released Text Messages Reveal Tucker Carlson Said he ‘Passionately’ Hates Trump]